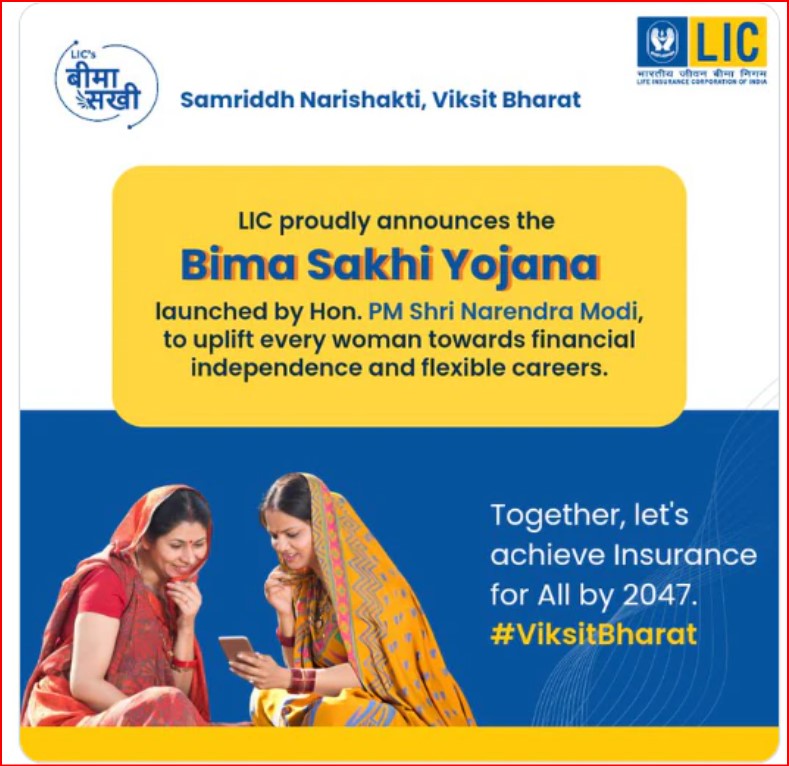

Empowering Rural Women Through Employment Opportunities

LIC launched the Bima Sakhi Yojana to empower women in rural regions by providing them with training and jobs as Bima Sakhis, or insurance brokers. The program is designed to provide women between the ages of 18 and 70 who have finished at least class 10 with the necessary abilities to market insurance products. In addition to promoting financial independence, this program tackles the dearth of job prospects in rural areas. Women who participate in this program can increase their household income and become more well-known in their communities.

Table of Contents

Building Financial Security and Sustainable Earning Potential

Women can achieve financial independence by selling life insurance policies and earning a consistent income as Bima Sakhis. They may manage their obligations to their families while obtaining fulfilling career thanks to this possibility. The program promotes women’s financial independence, which raises their confidence and social standing. Women in rural India, where employment opportunities may be few, can now pursue an empowering and long-lasting career in insurance thanks to the Bima Sakhi Yojana.

What Makes the Bima Sakhi Yojana Unique? Key Features Explained.

Training for Empowerment: A Million Women to Become LIC Agents

The Life Insurance Corporation of India (LIC) wants to educate one lakh women throughout India as part of the Bima Sakhi Yojana. These ladies, who range in age from 18 to 70, will get in-depth instruction in the life insurance sector. To become successful LIC agents and financial supporters, they will acquire crucial knowledge about insurance products, sales strategies, and customer relations.

Promoting Financial Literacy and Employment Opportunities

This program encourages financial literacy in rural regions while also generating jobs. When it comes to teaching their communities about insurance, savings, and financial stability, trained women will be essential. By empowering others, promoting financial independence, and contributing to their homes’ income, Bima Sakhis will ensure a beneficial socio-economic impact throughout rural India.

How the Bima Sakhi Yojana Provides Financial Backing During Training.

Women who are training to become LIC agents are given a structured financial stipend through the Bima Sakhi Yojana. Trainees are paid Rs 7,000 a month in the first year, Rs 6,000 in the second, and Rs 5,000 in the third. With this financial assistance, women may concentrate entirely on their career advancement without having to worry about money problems. It helps them become successful LIC agents by giving them the confidence and real-world experience they need to succeed in their new positions.

Empowering Rural Women with Career Opportunities and Independence.

In rural areas, the Bima Sakhi Yojana seeks to empower women by providing steady work opportunities and encouraging financial independence. Women have the opportunity to become LIC agents through this program, which is especially beneficial in areas where women have few employment options. In addition to securing a steady income, women who take part in this program make significant contributions to their communities. The program is essential to the advancement of gender equality in the workplace because it gives rural women a road to self-reliance and professional achievement.

Building Financial Awareness: Women Leading the Way in Rural Communities.

Women are not only explained to sell insurance plans under the Bima Sakhi Yojana, but they also play a significant role in teaching financial literacy in their communities. They assist people in making well-informed decisions on their financial well-being by increasing understanding of the significance of insurance, savings, and financial planning. By empowering women to become change agents, this program makes sure that more individuals, particularly in rural regions, have access to financial security and understand the advantages of financial management and insurance.

Bima Sakhi Yojana: A Step Towards Achieving Financial Inclusion and Empowerment.

The Indian government’s goals of financial inclusion and women’s empowerment, particularly in underprivileged rural areas, are perfectly aligned with the Bima Sakhi Yojana. The program encourages women to enter the insurance industry, which not only gives them a source of income but also promotes their financial independence and self-sufficiency. Their families also benefit from this empowerment, which addresses gender inequity and uplifts entire communities. The initiative also helps to improve the general economic stability of rural India, as these women are essential in promoting financial inclusion.

For More updates visit the official website: Bima Sakhi Yojana